Is Child Support Taxable in Florida?

Is child support taxable in Florida? It’s a big question, but the answer might surprise you. Think of child support like lunch money; it’s meant for your child’s needs, not for tax season games. Many parents in Florida wonder if they should report it, deduct it, or just hide under a tax blanket. Don’t worry, we’re going to make this easy.

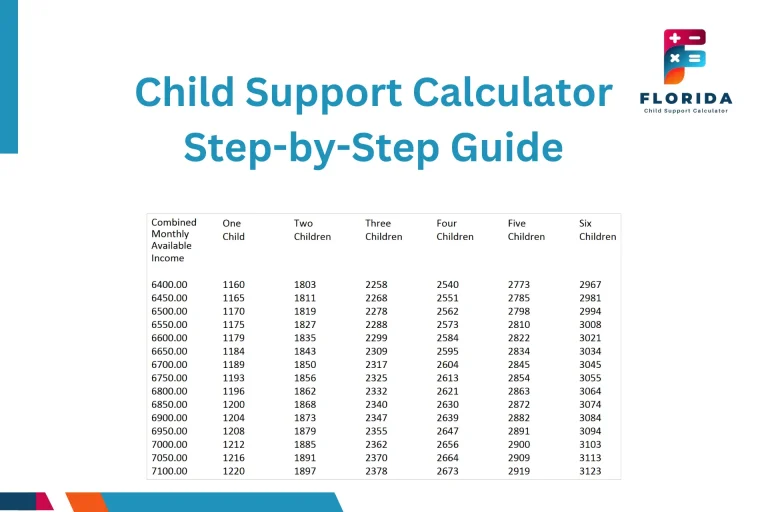

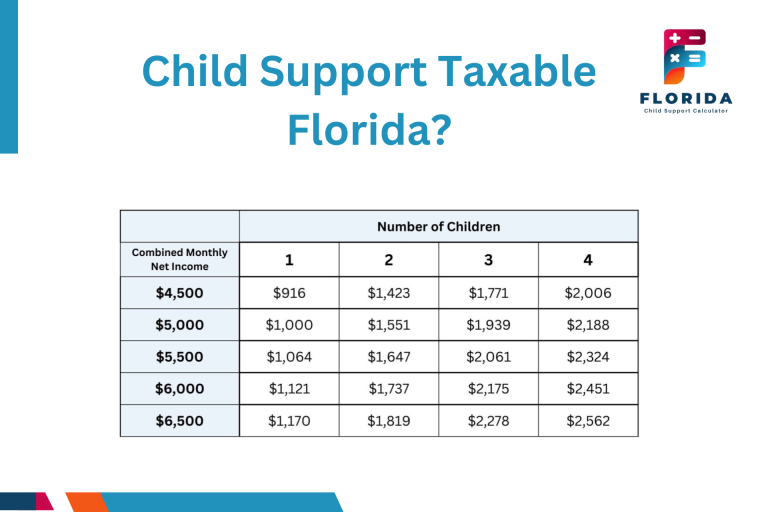

Florida has its own rules, but so does the IRS. We’ll walk through it all, including how child support is calculated in Florida and how income affects your payments. Stick with us, no fancy tax words, just simple answers with real-life examples. And yes, we’ll bust some myths too.

Comparing Child Support vs. Alimony for Florida Taxes

Child support and alimony might sound the same, but both are court-ordered payments after a split, and they’re very different when it comes to taxes. You shouldn’t mix them up, or you might end up with trouble from the IRS.

Alimony Rules Before and After the 2017 Tax Law Change

Before 2018, alimony was tax-deductible for the person paying it and taxable for the one receiving it. But after the Tax Cuts and Jobs Act, the IRS changed that. Now, for divorces after 2018, alimony is no longer deductible or taxed.

On the other hand, child support has never been deductible, no matter the year. If you’re wondering how Florida handles both types of support, here’s how child support and alimony differ in Florida. It’s a key part of knowing your rights and duties.

Why Child Support Is Always Tax-Neutral

Child support is like buying groceries for your child. You don’t get taxed for buying milk, right? Same here, it’s not counted as income, and you can’t write it off. This applies in Florida and across the U.S.

People often assume they’ll get a tax break, but that’s not the case. If you’re calculating support or figuring out your income, check how Florida uses income to calculate child support. But remember, taxes aren’t part of that math.

Mixed Orders: Paying Both? Here’s What You Need to Know

If you’re paying both child support and alimony, it can get tricky. In Florida, courts may order both if needed. But when tax season rolls around, treat them separately.

Some Florida parents share their stories about how child support is calculated differently than spousal support, especially when income changes. That’s why it’s smart to know the difference early.

Tax Planning for the Custodial Parent

If your child lives with you most of the time, you’re the custodial parent, and that gives you certain rights and tax benefits. But you also need to know the rules, or you could miss out on credits or make a mistake with the IRS.

Understanding IRS Form 8332

Form 8332 is what the IRS uses when the custodial parent gives permission for the other parent to claim the child on taxes. If you don’t fill it out right, things can go wrong.

Many parents have questions about claiming their child as a dependent, especially when there’s joint custody. This form makes things legal and clear, no guessing or verbal deals.

Claiming a Child as a Dependent Who Gets to Do It?

The IRS rule is simple: the custodial parent usually gets to claim the child. But if there’s a court order or signed Form 8332, the non-custodial parent might claim instead.

Some parents try to do it without agreement, and that leads to both parents filing for the same child, not good! You’ll find answers on Florida’s child support forms page that help with custody and support details.

Dependency Claims and Common Mistakes

Many people think just paying child support means you get the tax credit, but that’s not how it works. The IRS only looks at who the child lives with most of the year.

If you’re in doubt, look at Florida’s support rules. They explain how custody, support, and income connect and how that affects dependency claims.

Tax Credits Available to Parents in Florida

Being a parent comes with expenses, but also some helpful tax credits. If you qualify, you might lower your tax bill or even get money back. But not all credits work with child support, so let’s sort it out.

Child and Dependent Care Tax Credit Explained

This credit helps if you pay someone to watch your child while you work. It’s not connected to child support payments, it’s based on care costs, not court orders.

If you’re receiving support and paying for daycare, you might still qualify. The IRS looks at your work status, not your support status. You can read more about how Florida calculates support based on expenses, but tax credits are a separate issue.

Earned Income Credit & Child Support Limits

The Earned Income Tax Credit (EITC) gives money back to low-income working parents. But here’s the catch: if you’re the non-custodial parent paying child support, you usually can’t claim the credit.

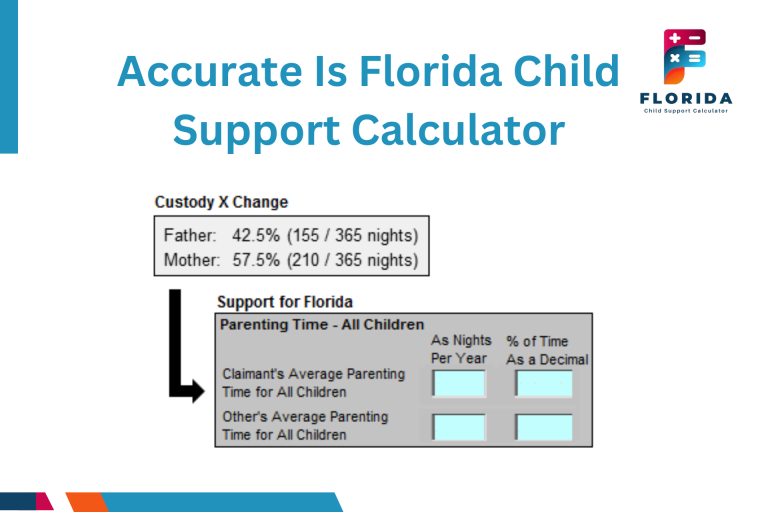

Florida parents who split custody should pay close attention to how the court splits support based on custody. That custody split affects who qualifies for EITC.

Health and Retirement-Related Deductions (List Format)

Some child support orders require one parent to pay for health insurance or savings for the child. But are those deductible? Here’s a list of what isn’t tax-deductible under IRS rules, even if it’s part of your support order:

- Health insurance premiums are paid for the child

- Retirement savings (like college funds)

- School supplies and activity fees

- Transportation or travel for custody visits

These costs matter for your child, but they don’t help with your taxes. To understand what can affect your support amount in Florida, check the income-related factors courts look at.

Comparing Child Support vs. Alimony for Florida Taxes

Child support and alimony might sound the same, but both are court-ordered payments after a split, and they’re very different when it comes to taxes. You shouldn’t mix them up, or you might end up with trouble from the IRS.

Alimony Rules Before and After the 2017 Tax Law Change

Before 2018, alimony was tax-deductible for the person paying it and taxable for the one receiving it. But after the Tax Cuts and Jobs Act, the IRS changed that. Now, for divorces after 2018, alimony is no longer deductible or taxed.

On the other hand, child support has never been deductible, no matter the year. If you’re wondering how Florida handles both types of support, here’s how child support and alimony differ in Florida. It’s a key part of knowing your rights and duties.

Why Child Support Is Always Tax-Neutral

Child support is like buying groceries for your child. You don’t get taxed for buying milk, right? Same here, it’s not counted as income, and you can’t write it off. This applies in Florida and across the U.S.

People often assume they’ll get a tax break, but that’s not the case. If you’re calculating support or figuring out your income, check how Florida uses income to calculate child support. But remember, taxes aren’t part of that math.

Mixed Orders: Paying Both? Here’s What You Need to Know

If you’re paying both child support and alimony, it can get tricky. In Florida, courts may order both if needed. But when tax season rolls around, treat them separately.

Some Florida parents share their stories about how child support is calculated differently than spousal support, especially when income changes. That’s why it’s smart to know the difference early.

Tax Planning for the Custodial Parent

If your child lives with you most of the time, you’re the custodial parent, and that gives you certain rights and tax benefits. But you also need to know the rules, or you could miss out on credits or make a mistake with the IRS.

Understanding IRS Form 8332

Form 8332 is what the IRS uses when the custodial parent permits the other parent to claim the child on taxes. If you don’t fill it out right, things can go wrong.

Many parents have questions about claiming their child as a dependent, especially when there’s joint custody. This form makes things legal and clear, no guessing or verbal deals.

Claiming a Child as a Dependent: Who Gets to Do It?

The IRS rule is simple: the custodial parent usually gets to claim the child. But if there’s a court order or signed Form 8332, the non-custodial parent might claim instead.

Some parents try to do it without agreement, and that leads to both parents filing for the same child, not good! You’ll find answers on Florida’s child support forms page that help with custody and support details.

Dependency Claims and Common Mistakes

Many people think just paying child support means you get the tax credit, but that’s not how it works. The IRS only looks at who the child lives with most of the year.

If you’re in doubt, look at Florida’s support rules. They explain how custody, support, and income connect and how that affects dependency claims.

Tax Credits Available to Parents in Florida

Being a parent comes with expenses, but also some helpful tax credits. If you qualify, you might lower your tax bill or even get money back. But not all credits work with child support, so let’s sort it out.

Child and Dependent Care Tax Credit Explained

This credit helps if you pay someone to watch your child while you work. It’s not connected to child support payments, it’s based on care costs, not court orders.

If you’re receiving support and paying for daycare, you might still qualify. The IRS looks at your work status, not your support status. You can read more about how Florida calculates support based on expenses, but tax credits are a separate issue.

Earned Income Credit & Child Support Limits

The Earned Income Tax Credit (EITC) gives money back to low-income working parents. But here’s the catch: if you’re the non-custodial parent paying child support, you usually can’t claim the credit.

Florida parents who split custody should pay close attention to how the court splits support based on custody. That custody split affects who qualifies for EITC.

Health and Retirement-Related Deductions (List Format)

Some child support orders require one parent to pay for health insurance or savings for the child. But are those deductible?

Here’s a list of what isn’t tax-deductible under IRS rules, even if it’s part of your support order:

- Health insurance premiums are paid for the child

- Retirement savings (like college funds)

- School supplies and activity fees

- Transportation or travel for custody visits

These costs matter for your child, but they don’t help with your taxes. To understand what can affect your support amount in Florida, check the income-related factors courts look at.

What Expenses Are Not Tax-Deductible with Child Support?

Many parents assume that if they’re spending money on their child, they can write it off during tax season. But most child-related expenses, even if court-ordered, are not tax-deductible under IRS rules. That’s why knowing what counts and what doesn’t is super important.

Non-Tax-Deductible Expenses (List Format)

Here’s a list of common child support-related expenses that cannot be deducted from your taxes, even if they’re required by court:

- Daycare fees or babysitting

- School supplies and tuition

- Sports and club fees

- Medical bills (unless itemized separately under healthcare rules)

- Rent or utility payments for your ex’s home

- Holiday or birthday gifts

Even though these costs matter in court, they don’t matter to the IRS. If you’re curious how courts decide what to include in support, you can check Florida’s support influence factors for more examples.

At the end of the day, child support is for the child’s living needs, not for lowering your tax bill.

Florida Department of Revenue & Support Enforcement

In Florida, the Department of Revenue (DOR) manages child support enforcement. They help make sure payments are fair, on time, and legally handled. They also deal with income withholding and court reporting.

Enforcement Programs and Payment Tracking

Florida DOR has strong systems to track child support payments, collect overdue money, and even suspend driver’s licenses if parents stop paying. These rules are serious, and enforcement is strict.

If you’re dealing with missed payments or want to know how they check income, the Florida child support calculation process shows what factors they review.

DOR’s enforcement isn’t just about collecting, it’s also about helping kids get what they need, even if one parent falls behind.

2024 Updates to Parent Rights and Filing Rules

Florida made some changes in 2024 about how parents file documents, claim children, and report financial changes. Now, both parents must share financial updates more often and with clearer forms.

To keep things fair, courts follow the child support laws in Florida closely, especially when it comes to income changes and shared custody.

These updates are meant to reduce confusion and improve child-focused results in court.

How DOR Communicates Tax Obligations

While DOR doesn’t control taxes directly, it does send reports that may affect federal refunds. For example, if a parent owes back child support, DOR can flag their IRS refund and have it redirected.

Some parents in Florida don’t even realize this until tax season hits. If you’re unsure about how support and legal consequences connect, this quick read on jail time for unpaid support will give you clarity.

Common Myths About Child Support and Taxes

There’s a lot of bad info out there. From Facebook threads to uncles with “tax tips,” parents hear things that just aren’t true. Let’s bust some of the biggest myths about child support and taxes in Florida.

I Thought I Could Deduct It!

One of the biggest myths is that you can deduct child support if you’re paying it. Nope. It’s not deductible. Not in Florida. Not federally. It never has been.

Even though many people confuse child support with alimony, they have different tax treatments. You can get clear on the child support vs alimony tax differences before making any tax-time mistakes.

I Pay Everything, Why No Refund?

Just because you pay more doesn’t mean you get more tax credits. The IRS doesn’t reward support payments with refunds, it rewards custody and care.

Parents who file for the Child Tax Credit or Earned Income Credit should read what happens when both parents work and share custody. The answer may surprise you.

Legal vs. Tax Logic (Paragraph)

Legal orders and tax rules are not the same thing. Just because a judge tells you to pay something doesn’t mean it has a tax impact. Always check the IRS rules and Florida DOR guidance before filing.

If you need help figuring it all out, Florida’s child support guidelines are a good place to start.

When Should You Get Legal Help for Child Support and Taxes?

Sometimes things get tricky. Maybe your income dropped. Maybe your custody changed. Or maybe your ex isn’t following the agreement. That’s when talking to a child support lawyer in Florida can really help, especially when taxes are also part of the puzzle.

When Income Changes Affect Child Support Obligations

If you lost your job or started making a lot more money, your support order may need to be updated. Courts look at new income, but so does the IRS when it comes to credits and claims.

To learn how income matters in these cases, check this info on how Florida calculates support with income changes. It explains what you’ll need to share and what the court expects.

Don’t wait too long; if your payments don’t match your real income, both legal and tax problems can follow.

Complex Situations Like Multiple Kids or States

If you have kids in more than one household or live in a different state from your child, things get confusing fast. Tax credits, filing rights, and payment tracking can vary depending on state rules and agreements.

In Florida, the courts still follow clear rules. You can review the child support guidelines in Florida to see how these situations are handled.

You might also need legal help if one parent is moving or asking to modify custody, because that affects support and tax filings, too.

How a Tampa Child Support Lawyer Can Help

A lawyer can explain what the Florida Department of Revenue will expect from you and what the IRS needs at tax time. They can also help you file motions, fill forms, and fix past mistakes.

To avoid getting letters from both the court and tax offices, it’s smart to speak with a pro. And if payments are falling behind, you might want to read about the risks of jail for unpaid child support in Florida, because legal help is better than late help.

Key Points About Child Support and Florida Tax Rules

Let’s make it super clear. If you’ve read this far, you now know that child support and taxes don’t mix much, but here’s a recap so you remember what matters most.

Summary of Key Tax Rules (Bullet Format)

- Child support is not taxable for the parent receiving it

- It is not deductible for the parent paying it

- Custodial parents usually claim the child on taxes

- IRS Form 8332 is needed for special claim cases

- You can’t deduct extras like tuition or gifts

- Florida follows federal rules, so there’s no extra state tax

If you’re wondering how child support orders are created to match these rules, Florida’s support laws cover that well.

You don’t have to be a tax expert; just follow the basics and file smart.

FAQs About Child Support and Taxes in Florida

Still scratching your head? No worries. Let’s answer some of the most common questions Florida parents ask about child support and tax filing.

Are child support payments tax-deductible in Florida?

No, they’re not. Florida follows federal tax laws, so child support is not tax-deductible for the paying parent. That’s true whether you’re paying $100 or $1,000 per month.

To understand why this rule exists, you can explore how Florida treats child support legally and how it compares to alimony payments.

What should I do if my income changes significantly and affects my child support payments?

You should act fast. Go to court and ask for a review. Waiting can lead to overdue payments that still count, even if you lost your job.

Before doing that, it helps to know how support amounts are set in Florida and what counts as a valid income change.

Can I claim my child on taxes if I pay child support but don’t live with them?

Not unless the custodial parent gives written permission using IRS Form 8332. Just paying child support doesn’t give you the right to claim your child on your tax return.

If you have shared custody, see what happens when both parents work in Florida, because tax rules may differ from your parenting plan.

Final Thought

Let’s wrap this up. Child support can feel complicated, especially when taxes get involved. But you now know what matters most: child support isn’t taxable or deductible, and filing smart starts with knowing your role as a parent.

Whether you’re paying support or receiving it, make sure you’re filing your taxes the right way. If you’re ever unsure, it’s okay to revisit Florida’s legal child support process or talk to a pro.

And don’t forget: the IRS looks at who your child lives with, not who pays more. For extra help, this breakdown of how Florida courts handle support and custody may be helpful if your situation changes.