Understanding Florida’s Child Support Worksheet

Understanding the Florida Child Support Worksheet might sound like decoding ancient math, but don’t worry, we’re going to make it super simple. This worksheet (officially called Form 12.902(e)) decides how much child support one parent should pay, based on income, parenting time, and other costs like daycare and insurance.

Think of it like a recipe, just mix the right numbers in the right order, and the court gets a fair result. If you’re wondering how Florida calculates child support or what forms you’ll need, we’ve got your back. Let’s break this down together, no legal jargon, no headaches, just clear answers that make sense.

What Is the Florida Child Support Worksheet and Why Should You Care?

If you’ve got kids and you’re splitting up in Florida, you’ll probably deal with the Florida Child Support Worksheet, even if you think you don’t need it. This form isn’t just paper; it’s how the court decides what’s fair when it comes to raising your child.

One reason this form matters so much is that it works hand-in-hand with Florida’s official child support guidelines. Judges use it to check if both parents are doing their part. It’s not optional, even if both parents have already agreed on an amount, the worksheet still has to be filed. If you’re not sure what forms to gather for your case, this child support forms in Florida page will help.

Florida Form 12.902(e) Explained

This is the full name of the worksheet you’ll fill out: Florida Family Law Form 12.902(e). It calculates your basic monthly obligation and considers health costs, daycare, parenting time, and more. It’s part of every divorce or custody case involving minor kids.

In many cases, parents also file this form alongside the Florida child support calculator tool, but don’t get it twisted, the calculator gives estimates, while the worksheet is legally required.

Why It’s Required by Florida Law (§ 61.30)

This worksheet is required under Section 61.30 of Florida law. The rule says every parent must financially support their child, and this worksheet is the math behind that law. It makes sure the amount is fair based on each parent’s income.

Also, when you’re trying to reduce child support payments, this worksheet must be updated and refiled. Even for minimum child support situations, the court needs these numbers in writing. It’s how the law protects the child, not the parents.

How and When to File the Worksheet in Florida

Filing the worksheet might sound scary, but it’s just about timing and paperwork. You don’t need a lawyer to do it, just the right info and a bit of care. And yes, even self-represented parents have to file it.

Where to Download the Official Form 12.902(e)

You can grab the worksheet straight from the Florida Courts site. It’s a downloadable PDF, and you’ll either type into it or print it out. Keep in mind, if you’re also filing other Florida child support forms, this one is usually on top of the pile.

If you’re unsure about the next step, our child support calculator guide walks through how these forms work together.

When Filing Is Required (and When It’s Not)

The worksheet is required any time child support is being discussed. That includes divorce, custody, support modification, and even temporary orders. But here’s the catch: if you don’t know the other parent’s income, you wait until they file their financial affidavit.

If you’re facing a child support modification or wondering whether parents are required to work to pay support, filing this worksheet is still part of the process.

E-filing vs. Paper Filing: What You Need to Know

In Florida, most people now file this form online. But self-represented parents can still use paper. Just make sure your certificate of service matches the delivery method: email, mail, or hand delivery. Filing rules are all listed under Florida’s official e-filing system.

If you’re unsure how this affects your income reporting, you can refer to how income is calculated for child support before submitting the form.

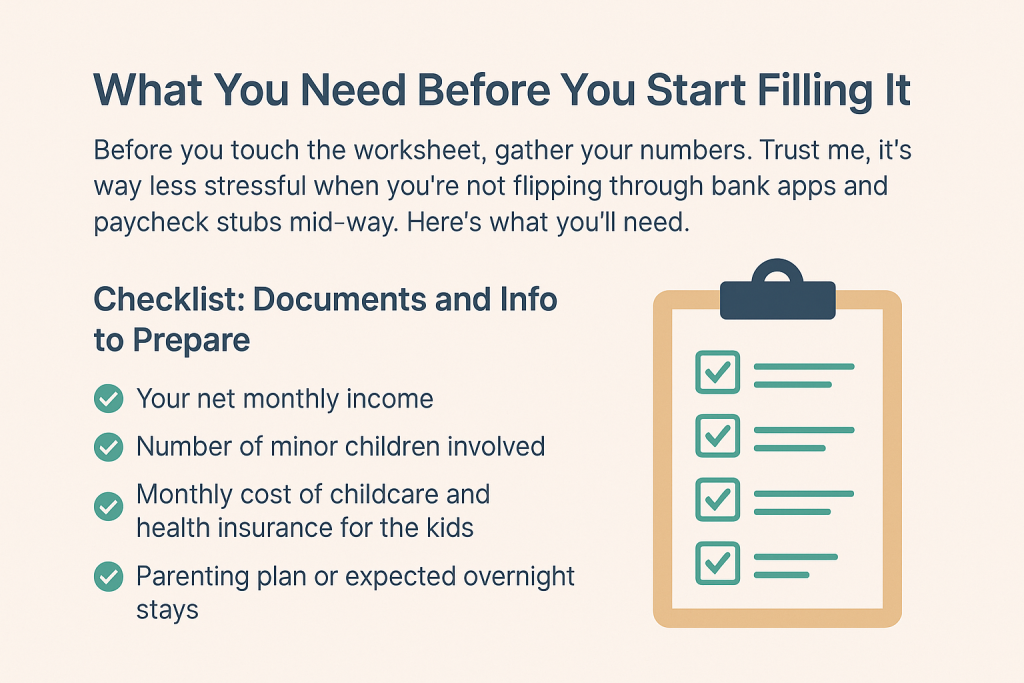

What You Need Before You Start Filling It

Before you touch the worksheet, gather your numbers. Trust me, it’s way less stressful when you’re not flipping through bank apps and paycheck stubs mid-way. Here’s what you’ll need.

Checklist: Documents and Info to Prepare

- Your net monthly income (check how it’s calculated in Florida)

- Number of minor children involved

- Monthly cost of childcare and health insurance for the kids

- Parenting plan or expected overnight stays

- The other parent’s financial affidavit (if available)

If you’re curious about what can change the numbers, take a quick look at the factors that influence child support amounts.

Also, don’t forget that if either parent requests a different amount than the worksheet says, a motion to deviate must be filed with it.

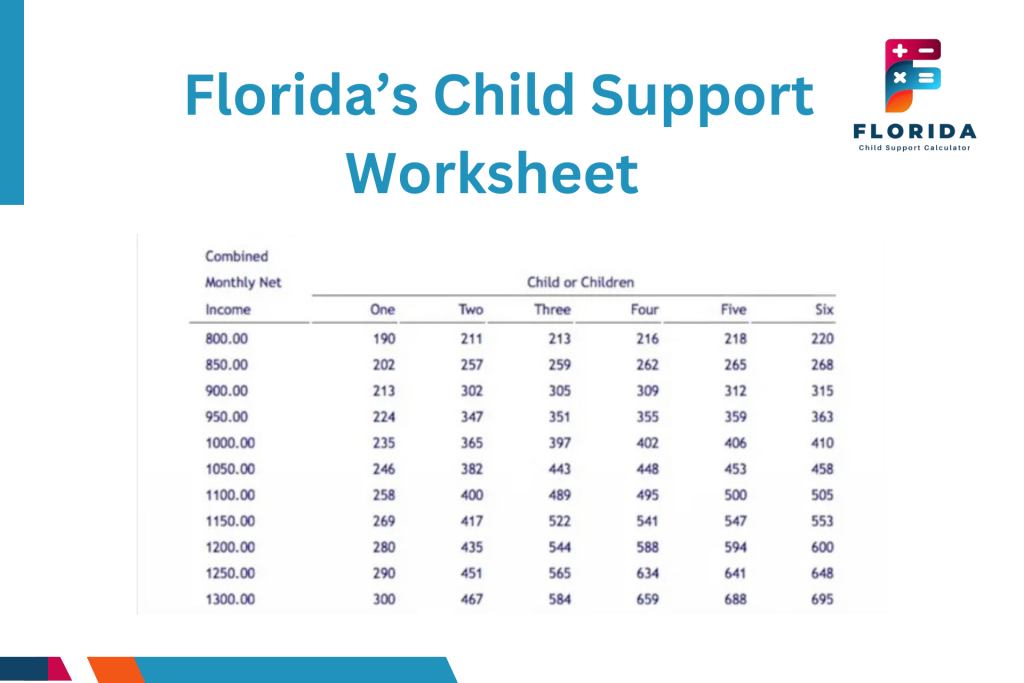

Florida Child Support Guidelines Table (Straight From the Worksheet)

The worksheet doesn’t work on guesswork, it uses a set chart that matches your total income and number of children. This chart is part of Form 12.902(e) and is based on Florida’s official child support law.

If you’re trying to estimate your monthly support based on income, the child support calculator helps, but the final numbers must come from this chart. The table below includes sample figures straight from the official document:

Simplified Florida Child Support Table (Monthly Obligation)

| Combined Income | 1 Child | 2 Children | 3 Children |

|---|---|---|---|

| $2,000 | $442 | $686 | $859 |

| $3,000 | $644 | $1001 | $1252 |

| $4,000 | $828 | $1288 | $1603 |

| $5,000 | $1000 | $1551 | $1939 |

This table only shows a small portion. The full worksheet includes values from $800 to $10,000+ income. And yes, if you’re dealing with a low-income case, you might also want to check the minimum child support rules in Florida.

Example: Filling Out the Child Support Worksheet

Filling out the Florida Child Support Worksheet might feel like doing taxes, but don’t worry. Here’s how to break it down one step at a time. This part matters because errors here affect how much support you give or receive.

If you’re confused between estimated vs. real numbers, just know the official child support guidelines are what courts use to double-check your math.

Add Both Parents’ Net Monthly Income

You’ll need to pull the income details from each parent’s financial affidavit (Form 12.902(b) or (c)). Add those together. For example, if one parent earns $3,000 and the other earns $2,000, your combined net monthly income is $5,000.

We explain how income is calculated in Florida, including bonuses, self-employment, and part-time jobs. Don’t skip these!

Use the Chart to Find Basic Obligation

With that combined income and number of kids, go to the child support chart (like the one above) and find the amount. If the couple has two kids and $5,000 combined income, the basic obligation is $1,551/month.

This figure is important later, especially when discussing factors that influence support, like daycare and medical costs.

Split the Cost Based on Income Percentage

This is where fairness comes in. If Parent A makes $3,000 of the $5,000 total, that’s 60% of the income. So they owe 60% of the support, which would be about $930/month in this case.

And don’t worry, we’ve covered how child support is actually calculated using these splits in more detail.

Add Childcare, Insurance, and Health Costs

You also add in:

- Monthly daycare cost

- Health insurance paid for the kids

- Medical or dental services not covered by insurance

Split these based on the same income percentages. So if daycare is $500 and your share is 60%, that’s $300.

Even if you plan to request a lower amount, the worksheet must reflect these costs before you ask the court for a support reduction.

What Happens If You Share Parenting Time? (The Gross-Up Method)

Now here’s where things shift: if both parents share time with the kids, especially over 20% of the nights in a year, the worksheet uses a different formula. It’s called the Gross-Up Method, sounds scary, but it’s helpful in shared custody cases.

This is common in 50/50 or 60/40 parenting plans. Florida law uses the child’s overnight stays with each parent to recalculate support. You’ll find this method explained in more detail under child support calculation rules.

The 20% Overnight Rule Explained

If either parent has the child for 73 nights or more per year, the court requires the Gross-Up Method. You multiply the basic obligation by 150% first, then split it based on overnights.

Even parents who split time evenly still owe support based on income differences. The child support calculator doesn’t fully cover this, so don’t rely on that alone.

Why Time-Sharing Impacts Payment

Here’s the thing: parenting time is more than just visits. Overnights impact costs like meals, electricity, and school needs. So courts factor that in. If you handle more nights, your share might drop.

Still, both parents need to be contributing fairly. We’ve seen this issue in cases where both parents work and time-sharing isn’t balanced.

Common Mistakes Parents Make on the Worksheet

Filling out the Florida Child Support Worksheet isn’t rocket science, but one mistake can throw off everything. From wrong income to missing expenses, these errors can cause unfair payments or even court delays.

Mixing Up Gross vs. Net Income

This one’s a biggie. The worksheet needs net income, not your salary before taxes. People often grab numbers from pay stubs without removing deductions, and boom, the whole support amount is off.

If you’re unsure what counts as income, revisit how Florida calculates child support income. Bonuses, side jobs, and even disability payments matter.

Forgetting Bonuses, Side Jobs, or Irregular Income

Many parents leave out extra income sources like freelance gigs, commissions, or overtime. The court expects everything on the table. If your income goes up and the worksheet stays outdated, you could owe back payments later.

To avoid this, it’s smart to update your worksheet before filing any child support adjustment request or arguing for less.

Not Including Childcare or Insurance Paid by You

Parents sometimes forget to claim what they’re already paying, like monthly daycare or the child’s health insurance. These can reduce your obligation if you calculate them correctly.

If you’re already making payments and want credit for them, make sure it reflects in your support calculation section.

Want to Change the Amount? Here’s When You Can

Child support amounts aren’t locked forever. If your life changes, job loss, more parenting time, or major expenses, Florida law lets you ask for a new amount. But yes, the worksheet needs to be updated first.

Life Changes That Trigger a Recalculation

Here are a few situations that can call for a support update:

- Job loss or major pay cut

- New job with much higher income

- The child starts full-time daycare

- Parenting plan changes (e.g., more overnights)

In such cases, courts look at new data and re-run the Florida child support worksheet to decide the updated amount. Even for a minimum child support case, this rule applies.

How to File for Modification in Florida

Start by filing a motion to modify child support, and attach a new worksheet based on your current income and expenses. You’ll also need to serve the other parent with a copy.

Also, keep records of health expenses, insurance payments, and child care; these can reduce your obligation. If your support needs to go down, courts will ask whether both parents are working and contributing their fair share.

Calculator vs. Official Worksheet: What’s the Difference?

People love online tools. But when it comes to child support in Florida, the worksheet and the calculator are not equal. One gives estimates. The other is required in court.

FL DOR Online Calculator Pros & Cons

The Florida Department of Revenue offers a free online calculator. It’s fast and simple. You plug in your income and kid count, and it gives you a ballpark support amount.

But here’s the thing: the calculator doesn’t cover everything, like adjustments for insurance or daycare. And it doesn’t file anything officially. Only Form 12.902(e) does that.

Why You Still Need to File the Official Worksheet

No matter what the calculator says, the court needs a real worksheet. Form 12.902(e) shows detailed numbers, income, overnight stays, and cost splits. Judges use it to check fairness.

If you’re confused about which form to use, take a look at all the child support forms required in Florida so you don’t miss anything. And always remember, even in shared parenting cases, the court needs numbers that are based on how child support is calculated in detail.

FAQ Florida Child Support Worksheet

When you’re dealing with child support in Florida, you’re bound to have questions. Here are the ones most parents ask, and yes, the answers are actually helpful.

Conclusion

The Florida Child Support Calculator Worksheet isn’t just another boring form, it’s the key to fair parenting responsibilities. It shows how much each parent should contribute, based on real-life costs and income.

You’re Not Just Filling a Form, You’re Protecting Your Child’s Future

Every number on that form tells a story: income, care costs, parenting time. It’s how the state ensures your child gets the support they deserve.

If you’re unsure what qualifies as minimum payments, this minimum support rule breakdown is a helpful read.